Did you know, there is a way to Refinance AND Remodel your home into the home you’ve been dreaming about? It may sound too good to be true, but I promise there is no catch. Most people fantasize about their dream home improvements or admire everyone else’s home projects from afar-but this could be you! If you have been on the fence about making these home improvements, by the end of this article you’ll be ready to put those dreams into action. Instead of moving to a new property, many homeowners are using the “cash out” refinance strategy to make these upgrades possible.

Cash Out Refinance

First, lets talk about refinancing your home. What exactly does this mean? Refinancing makes it possible for homeowners to minimize their monthly payments OR pay less interest over the course of the loan. Refinancing exchanges the original loan for another loan with a rate and term that is a financially better situation for the homeowner.

Here’s how this ties in with making home improvements. Instead of just a straight refinance, you can choose to do a “cash out” refinance on your current mortgage, which means you walk away with extra cash in your pocket. This option gives you the lowest long-term interest rate of any type of home equity borrowing. You’re paying less per month on your monthly mortgage payments, have a lower interest rate, AND at the same time, are able to make home improvements with the extra cash you’ve pulled out.

So, for example, lets say the mortgage balance on your home is $200,000.

If your home is valued at $300,000.

The equity in your home is about $100,000.

You decide to use the cash out refinance option and pull out $40,000 of that equity to remodel your home. Your new mortgage balance will now be $240,000. This still leaves you at 80% Loan To Value with your home. It’s one of the best option to do renovations, without breaking the bank.

What To Look Out For

In order to get the best rate possible, make sure to improve your credit score and pay off any outstanding debts.

A cash out refinance wouldn’t be considered the best option if you have been thinking of moving in the very near future. It is still worth your time to get an estimate, or check out how much you could save through this refinance option.

Making Home Improvements… How Much Does It Cost?

So you’ve got your wish list of TOP home improvements and extra cash in your pocket, but how do you outline your budget for all these upgrades? Here are some the most common home improvements and their different costs to give you some ideas.

Kitchen

“Kitchens are the most expensive areas of the home in terms of construction and where people spend most of the time in their homes”, according to Los Angeles architect Steve Straughen. Research has shown that kitchen remodeling has found to return more than 100 percent of the cost!

The cost of remodeling a kitchen can range anywhere from $5,000 to $20,000 depending how much you want to change. There are so many options to choose from, so it’s exciting to shop around and then make it unique to your style!

For remodel ideas that stay around the $5,000 side of the budget, you can install storage shelves, pull out counter tops, or update the lighting in your kitchen, or possible windows too. With this smaller budget, you could also upgrade one of your appliance like a fridge, dishwasher, or stove for example.

If you are looking to spend between $10,000 and $15,000 to remodel your kitchen, some common projects done with these prices include, upgrading your sink and faucet, adding a Tile Backsplash, Painting your Walls and Ceilings, or Installing High- End Kitchen Appliances.

With a budget of $15,000-$30,000, you can leave most of the work to professionals. With this budget you could build a beautiful kitchen island, or replace your counter tops to stone, wood, metal, or granite.

If your flooring is also getting worn out, consider taking this budget to upgrade that as well!

You can also get your custom cabinets installed. This is a project people will take on themselves or hire a professional cabinet company to come take over.

Bathroom

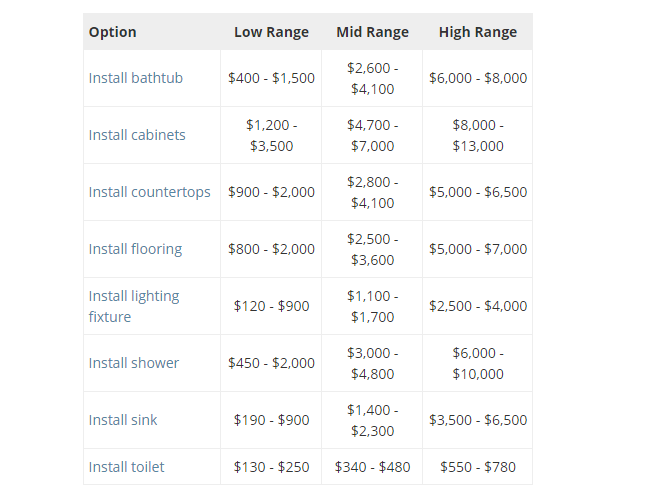

The average cost to remodel a bathroom ranges from $3500-$7000. Most homeowners spend about $10,000. Studies at Florida State University found that upgrading a bathroom increased the sale price by 8.7%, which is more than twice the rate for adding a bedroom.

Homeadvisor.com breaks down the prices for you to better plan out your budget

Flooring

Homeowners spend an average of $2,861 to redo their flooring. Even replacing old tile with some modern wood tiles or stone tiles can help increase your homes value. This is such a valuable investment and gives your home a much cleaner and trendy feel to it. Below are just a few ideas of what types of floors are trending.

Backyard

Just as the Kitchen can become a bit pricey with remodeling, so can your backyard. This is a great spot in your home to start investing into if this is where you and your family spend most of your time!

Consider the benefits you will reap down the road. Remodeling your front and backyard increases your home value like no other! For example, just fixing up your landscape increases your home value by 28 percent and cuts the amount of time the home is spent on the market by 10-15 percent.

Click here for more projects and backyard remodels that increase the value of your home.

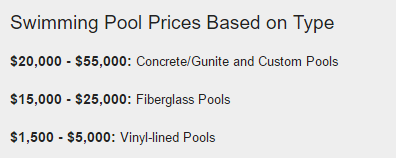

The most common investment for backyards is a swimming pool. According to Landscape Network, Swimming Pool prices vary in price depending on TYPE:

This is just a very basic break down of prices, considering there are many other features you may be interested in. It’s worth doing your research and finding the perfect pool to invest in, especially with intense summer heat!

If you are happy without a pool or any fancy new features, but your grass needs some TLC, consider using that extra cash in your pocket to invest in that! Put in some beautiful flowers, grass, artificial turf, or plant some trees. This costs less than a pool and can make all the difference in your home’s value and overall look.

A Gazebo and some cute lighting only costs about $500-$1,500. If you’re perfectly happy with your backyard but it could use something new, consider using some extra cash leftover to add a new look to it.

Here at Sun American Mortgage we want to help you remodel your home into something beautiful and save you money at the same time. Now is the time to get started-rates are currently at an all time low! Call us to talk about some of your options, or start with our simple online application. 480-832-4343