We’ve all seen the “Fixer-Upper” shows where they take a dingy house or room and transform into something magnificent, right? Have you been considering this as an option for your next home purchase, but don’t know where to start, or don’t have the money for all the renovations? Or maybe you found a house and it just needs the kitchen and a couple other areas upgraded to what you want. There is something exciting about taking something old and transforming it into something beautiful.

There are huge benefits to finding a home that is below market value that needs some work. The obvious ones are, you get to transform the home into the home of your dreams, while at the same time, bringing it’s value to the upper tier of the market. Most people don’t venture into this type of a purchase or project because they don’t know how to effectively do this, and most often are thinking to themselves…”where am I going to get the money to do all those renovations?”

Today we are going to show you how to make this all possible without draining your bank account.

GOOD NEWS! There’s a specific loan program called the Renovation Loan Program, and it fulfills all your re-modeling dreams and more!

What is the Renovation Loan Program?

This “home makeover” program loans you the money to accomplish all the upgrades you’ve been dreaming of. This program is all about taking a home that needs work and transforming it into something that in the end is worth more value. Whether the home needs major or minor repairs, a new pool, or you’d like a trendier kitchen- this program makes it possible to do it all.

PICTURE THIS

- You find the ideal home in the perfect community surrounded by great schools, and has a beautiful curb appeal. BUT the inside could use some major work.

- This home is on the market for say $225,000. You love everything about it, you’re ready to fix it up and make it your own. When you plan out renovation costs, let’s say they range anywhere from $50-$70K.

- So the total cost for this home including the renovations ends up being $275,000 – $295,000.

Here’s the BEST part! The Renovation Loan Program wraps all of these costs into one loan. No additional fees are asked of you except for your traditional down payment and closing costs.

Ok there’s one more BEST PART! When you do a renovation loan, we get to use the appraised value of what the home is going to be after all the renovations are done! SERIOUSLY?? Yep. You literally are walking into a new home with instant equity.

So sticking with our example above… If you did all those renovations and now your home appraises for let’s say, $325,000, you just set yourself up to not only have the home features you want, but now you have anywhere from $30,000 – $50,000 in equity right out of the gate. NO BRAINER right?

Requirements

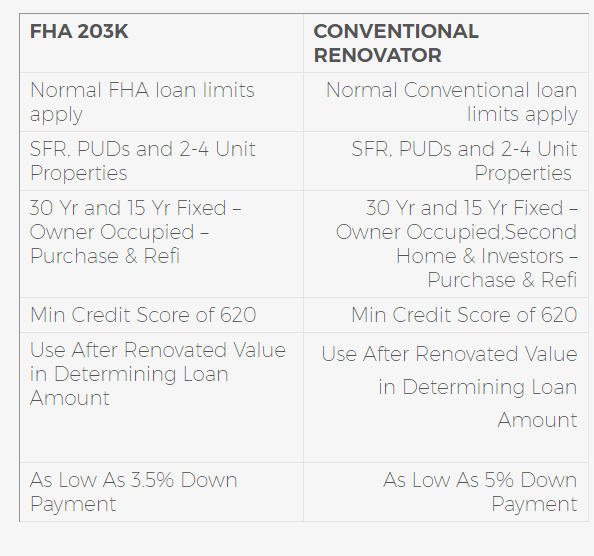

Here’s some basic requirements to help you decide which program type might be best. With the Renovation loan program, you can choose between an FHA 203K or conventional financing.

Benefits

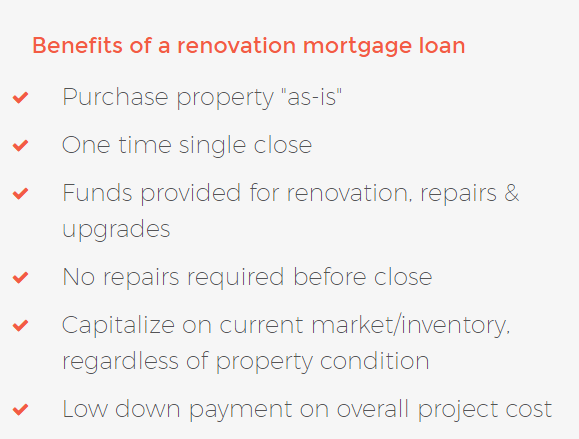

Aside from being able to create a beautiful new space AND save money at the same time, there are other fantastic benefits that come with this loan program!

Now that you know some of the requirements and benefits of a Renovation Loan Program, let’s see what you can do with it. These are just a few examples of what you can accomplish with this awesome financing option!

Remodel your Kitchen

Rip out ugly carpet and put in some beautiful wood floors or tiles. Put in some new lighting to brighten up the place. There are some pretty inexpensive changes that can make all the difference!

Have you always dreamed of having a giant bath tub? Or a HUGE walk in shower. A Renovation Loan Program makes that addition possible if the home you’d like to purchase doesn’t have them!

Is the backyard where you and your friends and family spend the most time? Consider using this loan to create a spectacular backyard where fun memories can be made!

Why wouldn’t you want to tailor a cheaper home to your style? Especially if there’s a way for you to save the money in your bank account.

According to statistics, there has never been a better time to buy a Fixer Upper home and renovate it. This program enables you to buy smart while everyone else is going after a pricier “move in ready” home. The fixer upper homes on the market are being overlooked and are waiting for you to customize them to your style.

Let’s make it happen!

Our team is well known for having the most organized and professional system set up to make the home-buying process as stress-free as possible. We walk you through all the steps to make this become a reality!

So let’s take the first step and call one of our expert Loan Officers to talk more about how this program can work for your next home purchase!

480-832-4343 or click here to use our Online Smart Application, “The Accelerator.”

References:

http://www.improvenet.com/a/renovation-financing

https://www.primelending.com/renovate-home/improve-a-home-loan-types/