Ready for some of the lowest rates?

We provide some of the most affordable and competitive home loan pricing in the Southwest. We invite you to get started by clicking on the button below to give you an instant mortgage quote!

Discover how you can save time and money for your next home purchase or refinance.

We provide some of the most affordable and competitive home loan pricing in the Southwest. We invite you to get started by clicking on the button below to give you an instant mortgage quote!

Whether you’re buying your very first house, third refinance or building a brand new house – we are here for you and ready to help.

Whether you’re buying your very first house, third refinance, or building a brand new house – we are here for you and ready to help.

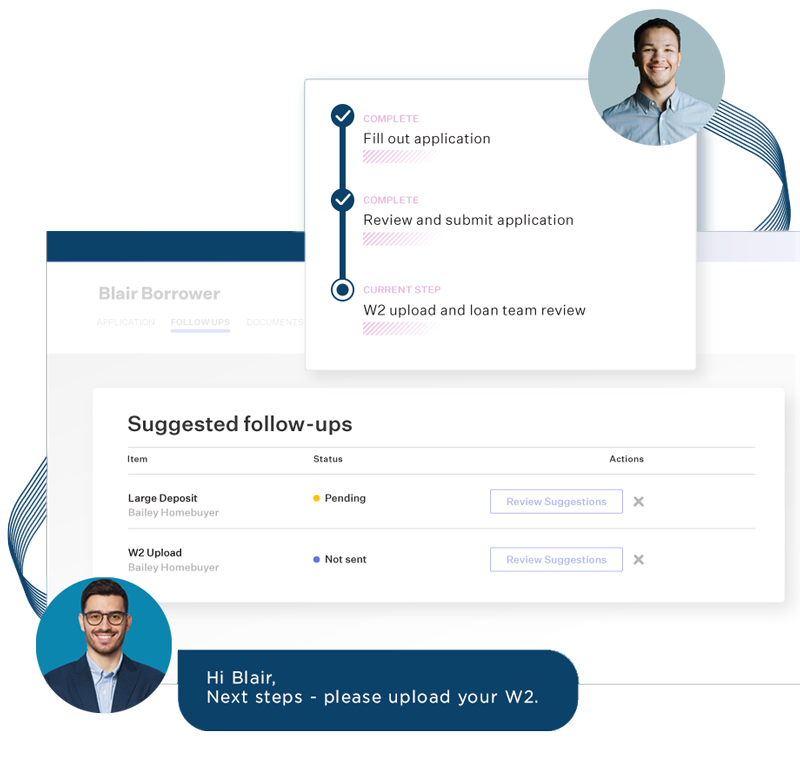

The traditional process of buying or refinancing a home can be downright stressful and confusing. We are breaking the status quo by making the process easy and accessible so you can sit back and relax.

We start with you!

Standing strong since 1984

Since 1984, we have strived to build a company that people can rely on and trust. We take pride in creating an experience that is Easy, Fast, and Memorable!

We are your go-to home loan lender

Getting a home loan can be stressful, but it doesn’t have to be. Our mortgage loan process takes you through step-by-step, with consistent communication, so you know what is going on every step of the way.

We make your buying or refinancing process so easy and seamless!

Getting you the best deals is what we love to do! We are ready to work hard for you!

We are known to have some of the fastest closing times around!

We make getting a mortgage and home loan FUN, exciting, enjoyable, and most importantly, stress-free.

4140 E. Baseline Rd. Ste 206 Mesa, AZ 85206 | NMLS 160265

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act License #413-0766

Fill in your details and I’ll get you a free mortgage payment quote!

Read the terms and conditions HERE.